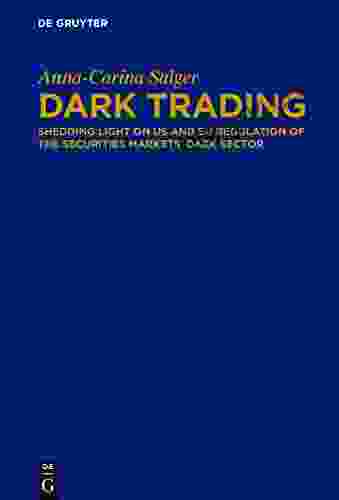

Shedding Light On Us And Eu Regulation Of The Securities Markets Dark Sector

The securities markets dark sector is a rapidly growing segment of the financial markets. Dark pools, which are private exchanges where investors can trade securities without disclosing their identities, have become increasingly popular in recent years. This growth has raised concerns among regulators about the potential for market manipulation and other abuses.

This book provides a comprehensive overview of the US and EU regulation of the securities markets dark sector. It discusses the history of dark pools, their current market share, and the regulatory challenges they pose. The book also provides an in-depth analysis of the existing regulatory frameworks in the US and EU, and makes recommendations for future reform.

Dark pools have been around for centuries. The first dark pool, known as the "London Stock Exchange Unofficial Market," was created in 1698. This market allowed investors to trade securities without disclosing their identities, which helped to reduce the risk of market manipulation.

5 out of 5

| Language | : | English |

| File size | : | 2633 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 530 pages |

Dark pools became increasingly popular in the 1990s, as electronic trading platforms made it easier for investors to trade anonymously. In the US, the first dark pool, known as the "Posit Trade," was launched in 1996. In the EU, the first dark pool, known as the "Turquoise," was launched in 2008.

Today, dark pools account for a significant share of the securities markets. In the US, dark pools account for approximately 15% of all equity trading. In the EU, dark pools account for approximately 10% of all equity trading.

The growth of dark pools has raised concerns among regulators about the potential for market manipulation and other abuses. Dark pools can be used to hide large Free Downloads from the public, which can make it easier for investors to manipulate the market. Dark pools can also be used to facilitate insider trading, as investors can trade on non-public information without being detected.

In response to these concerns, regulators have taken a number of steps to regulate dark pools. In the US, the Securities and Exchange Commission (SEC) has adopted a number of rules that require dark pools to register with the SEC and to disclose certain information to investors. In the EU, the European Securities and Markets Authority (ESMA) has adopted a number of rules that require dark pools to operate in a transparent and fair manner.

The US and EU have different regulatory frameworks for dark pools. In the US, the SEC has adopted a number of rules that require dark pools to register with the SEC and to disclose certain information to investors. These rules include:

- Regulation ATS, which requires dark pools to register with the SEC and to comply with certain transparency and recordkeeping requirements.

- Rule 605, which requires dark pools to disclose certain information to investors, such as the size and type of Free Downloads that are being traded on the dark pool.

In the EU, ESMA has adopted a number of rules that require dark pools to operate in a transparent and fair manner. These rules include:

- The Markets in Financial Instruments Directive (MiFID II),which requires dark pools to register with ESMA and to comply with certain transparency and recordkeeping requirements.

- The Market Abuse Regulation (MAR),which prohibits market manipulation and insider trading.

The existing regulatory frameworks for dark pools in the US and EU are a good start, but there is still room for improvement. The following are some recommendations for future reform:

- Increase transparency: Dark pools should be required to disclose more information to investors, such as the size and type of Free Downloads that are being traded on the dark pool, the identity of the participants in the dark pool, and the prices at which trades are being executed.

- Improve oversight: Regulators should have more oversight of dark pools. This could include requiring dark pools to submit regular reports to regulators, and giving regulators the authority to conduct inspections of dark pools.

- Strengthen enforcement: Regulators should strengthen their enforcement of the rules governing dark pools. This could include imposing more severe penalties on dark pools that violate the rules, and bringing more cases against individuals who engage in market manipulation or insider trading in dark pools.

Dark pools are a growing segment of the securities markets. They offer investors a number of benefits, such as anonymity and reduced transaction costs. However, dark pools also pose a number of risks, such as the potential for market manipulation and insider trading.

Regulators have taken a number of steps to regulate dark pools. However, the existing regulatory frameworks are still evolving. There is still room for improvement, such as increasing transparency, improving oversight, and strengthening enforcement.

By taking these steps, regulators can help to ensure that dark pools continue to provide benefits to investors while also protecting the integrity of the securities markets.

5 out of 5

| Language | : | English |

| File size | : | 2633 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 530 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Katie Martin

Katie Martin Kathleen Gerson

Kathleen Gerson Katty Kay

Katty Kay Kay Williams

Kay Williams Kathleen Davis

Kathleen Davis Julia Dray

Julia Dray K T Newman

K T Newman Jules Eden

Jules Eden Julie Summers

Julie Summers Katie Banks

Katie Banks Joseph Voelbel

Joseph Voelbel Julia Quinn

Julia Quinn Kathryn Smith

Kathryn Smith Julie M Fenster

Julie M Fenster Josh Mitteldorf

Josh Mitteldorf Kakkle Publications

Kakkle Publications Kaveh Hariri Asli

Kaveh Hariri Asli Kate Masur

Kate Masur K Michelle Edge

K Michelle Edge Julia Whitty

Julia Whitty

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Colt SimmonsEmpowering Consumers: A Comprehensive Guide to the National Consumer Credit...

Colt SimmonsEmpowering Consumers: A Comprehensive Guide to the National Consumer Credit...

Octavio PazTransform Your Body and Mind with the Ketogenic Cleanse: Unlock the Power of...

Octavio PazTransform Your Body and Mind with the Ketogenic Cleanse: Unlock the Power of... Yasunari KawabataFollow ·2.1k

Yasunari KawabataFollow ·2.1k Edwin BlairFollow ·13.5k

Edwin BlairFollow ·13.5k Ian McEwanFollow ·5k

Ian McEwanFollow ·5k Dashawn HayesFollow ·16.6k

Dashawn HayesFollow ·16.6k John KeatsFollow ·10.8k

John KeatsFollow ·10.8k Robbie CarterFollow ·15.5k

Robbie CarterFollow ·15.5k Neil GaimanFollow ·5.3k

Neil GaimanFollow ·5.3k Dylan MitchellFollow ·11.3k

Dylan MitchellFollow ·11.3k

Christian Carter

Christian CarterUnlock Your Cognitive Potential: Embark on a Brain...

"The Brain Fitness Workout"...

Cortez Reed

Cortez ReedLady Churchill's Rosebud Wristlet No. 33: A Timeless...

Embrace the Legacy of a Remarkable...

Hector Blair

Hector BlairAm Your Father, Brother: A Gripping Tale of Identity,...

A Heartfelt Exploration of Family Ties and...

Gary Cox

Gary CoxUnlock the Secrets of Brain Healing: A Neuroscientist's...

: The Revolutionary Power...

Eugene Scott

Eugene ScottMoments in Time: A Chronological History of the El Paso...

The El Paso...

Alexandre Dumas

Alexandre DumasUnlocking the Power of HAMP: A Comprehensive Guide to...

Homeownership is...

5 out of 5

| Language | : | English |

| File size | : | 2633 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 530 pages |